Affordable Care Act

Affordable Care Act Quote Form

Looking for coverage? Click any of the following links to submit a quote for quick, accurate and affordable rates.

Affordable Care Act Quote Form

Affordable Care Act Plans Information

What are Affordable Care Act Plans?

The Affordable Care Act, also known as Obamacare, is not insurance. It is however, a system by which the health insurance plans available in your state can be subsidized via a tax credit based on your family size and household income. If you are lower to middle income for your household size (please see chart below), the Affordable Care Act can make a HUGE difference in your annual medical costs. It also provides a golden opportunity to invest in other forms of insurance such as supplemental or life insurance in order to provide a much needed extra layer of insurance to protect your finances as well as your health.

|

2018 Total Household Income for Minimum and Maximum ACA Subsidy range

|

| Minimum |

Maximum |

|

1 person: $12,140

|

1 person: $48,560

|

|

2 people: $16,460

|

2 people: $65,840

|

|

3 people $20,780

|

3 people: $83,120

|

|

4 people $25,100

|

4 people: $100,400

|

|

5 people: $29,420

|

5 people: $117,680

|

|

6 people: $33,740

|

6 people: $134,960

|

|

7 people: $38,060

|

7 people: $152,240

|

|

8 people: $42,380

|

8 people: $169,520

|

What companies are available in Oklahoma?

Blue Cross has been the exclusive health insurance provider in Oklahoma for individual plans on the Marketplace for several years now. We believe that choice can be a great thing and we are happy to offer Medica this year to those seeking subsidized health insurance plans or for those with serious pre-existing conditions. Medica comes into Oklahoma for 2019 with great reviews and an attitude of service toward their clients. We expect great client user experience moving forward with Medica!

To view the 2019 Medica Plans for Oklahoma

Click Here

Critical illness, Accident/disability, Life Insurance and Dental for COMPLETE COVERAGE

Accident Plans Can be a life saver for everyone due to the high cost of modern Emergency Room visits! Families with Children and teens can benefit most especially from accident plans as this is one of the most common reason for ending up in the emergency room or urgent care. Your accident plan may completely cover your deductibles and co-insurance associated with your Health Insurance plan, thus leaving you with very little out of pocket expense for injury based medical events. In addition to the normal benefits from your accident plan, you can also add an accident disability plan to your coverage for just a few extra dollars per month. If you have a primary income earner in the household and would experience extreme financial distress if that income ended due to injury disability, this is a great back up plan!

Critical illness policies are supplemental insurance policies that provide a first occurrence "lump sum" payment directly to you in the event of certain diagnosis such as cancer. The benefits are paid directly to you not to the doctors or hospitals so the money is yours to use as you see fit and any remaining funds left over are your to keep. It is a great "one two punch" to protect yourself on the front side from medical treatment expenses with a great health insurance plan and to protect your finances on the back side with a great critical illness plan. Some of the unexpected expenses and financial burdens that you may experience as result of certain illnesses include:

- Medical treatments or certain drugs not covered by your health plan.

- Mortgage assistance while you are recovering.

- Bill payments such as car payments and insurance

- Experimental treatments not covered by traditional insurance Travel expenses for non-local treatment.

- Loss of income from being out of work.

Life Insurance is a crucial piece of the puzzle to protecting your family financially. Did you know, the standard equation for Life insurance includes 10 times the income of the insured, plus the future cost of your children’s college, plus your current debt? Does your life insurance policy cover these amounts? The truth is most families in America are extremely under-insured when it comes to Life Insurance and completely unprepared financially for the death of a spouse.

Dental and Vision plans are important to your families health and finances as well. The costs associated with a major dental procedure today can be a blow to your bank account. The solution would seem to be a dental plan but many dental and vision plans available today don't have very good benefits, are very expensive, have long wait periods and limited networks, so it requires extensive research to find the best ones. You're busy we know, so we do the homework for you in order to find the best options available today.

We offer the perfect solution!

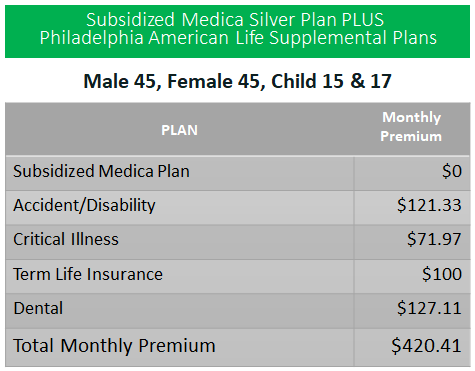

At Oklahoma Health Options we are always researching different companies, plans and benefits to provide our clients with the best options available on the market today. We have identified Philadelphia American Life as a perfect match for Affordable Care Act subsidized plans. By taking advantage of the federal subsidies applied toward your health plan, you can now afford additional insurance to provide complete protection.

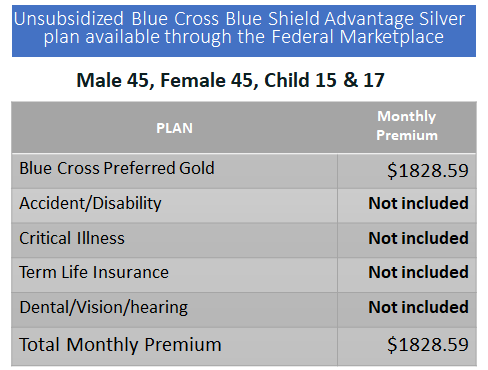

Compare for yourself this program to an unsubsidized Blue Cross Plan

*For example purposes only, results will vary based on household size, income and county. The quote above is for a family of four with annual household income of $75,000 living in Oklahoma County. Subject to change.

What Do I need to complete an application?

- Proof of income such as W-2, 1099, or tax return, which is required by the Federal Market place in order to determine you subsidy amount.

- An Active Checking account because most insurance companies have now gone to a auto draft from checking account as standard payment.

- Possibly your social security card in case the Federal Market Place requires further documents for proof of identity.

Clients who purchase this complete insurance solution, will have some of the best coverage available today at the best total cost. You and your family can have one less thing to worry about when it comes to an unforeseen medical event. Don't delay, contact us today to get started protecting yourself and your family!

Call 405-546-2000 today or to schedule your FREE consultation

CLICK HERE