Self Employed & Family Plans - Oklahoma

Self Employed & Family Plans Quote Forms

Looking for coverage? Click the following link to request a quick, accurate quote.

Family Plans Quote Form

Self Employed & Family Plans Information

The High Cost of the Individual market

The individuals and families across Oklahoma who must purchase insurance through the individual market have been some of the hardest hit by the rising costs of Health Insurance in the last few years. In Fact, some Oklahoma insurance premiums have increased by almost 500% since 2013. Individuals and families who make too much money to qualify for subsidies through the Federal Marketplace have felt the full effect of the premium increases. Many families we have consulted here at Oklahoma Health Options have seen their premiums increase to $2,000 per month and MORE! Rates like these are simply put…UNAFFORDABLE and many families have opted to go uninsured, thus putting themselves and their families at risk for costly medical events.

There are solutions!

One of the best solutions today involves taking advantage of a 2018 ruling by the federal government that allows for Short term plans to be renewable for up to 3 years. Short term plans were initially created for those needing to bridge a very short gap in time such as a few months between a move or between jobs. The extension to 3 year plans has caused insurance companies to add many benefits that one may be accustom to in their traditional health plans such as doctor visits, urgent care visits and prescription drug plans. View the interview below with our founder Russell Grafrath and the CEO of our parent company North American Insurance Services to learn more! Or click the quote form to get speak with one of our Insurance advisors.

CLICK HERE

Ranked one of the top Short Term Medical plans in the nation*

The Affordable Care Act

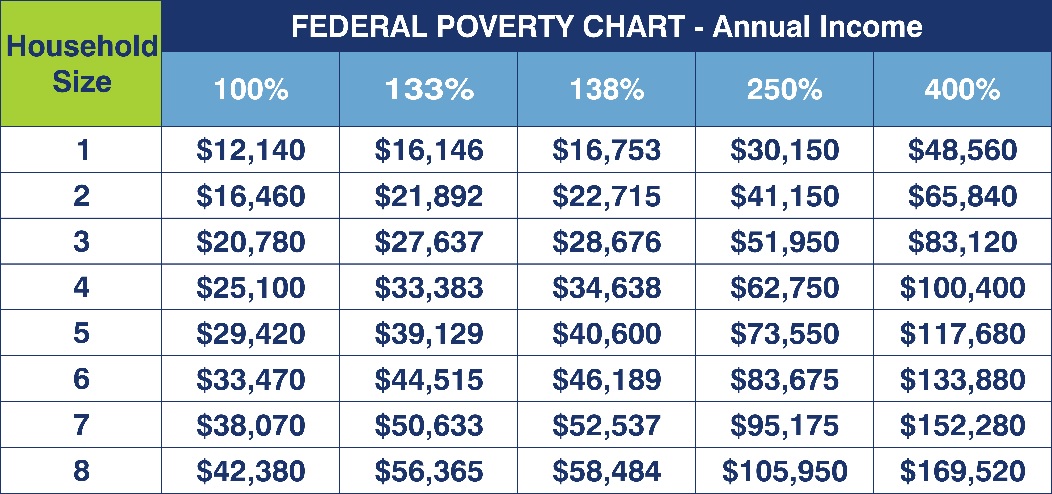

- The Affordable Care Act is now a viable option again for more income ranges due to the Inflation Reduction Act of 2022. Tax credits have been expanded to include families with incomes over 400% of Federal poverty level. For Example, a family of 5 with a house hold income of $75,000 can receive a monthly tax credit of approximately $1700 per month! Additionally, Affordable Care Act Plans come with some great benefits including:

No exclusions for pre-existing conditions

Comprehensive preventive benefits which can be found by clicking here

Large state and National Networks

See the chart below to see if you and your family qualify for tax credits

To learn more about Affordable Care Act Options

CLICK HERE

Call 405-546-2000 today or to schedule your FREE consultation

*Ranked by Forbes, Value Penguin and USA Today.

|