How to Choose Marketplace Health Insurance in Oklahoma

Choosing the right health insurance plan can be a daunting task, especially with the numerous options and factors to consider. Navigating the Health Insurance Marketplace requires careful evaluation to ensure you select a plan that fits your needs and budget.

This guide will walk you through the essential steps, from determining your eligibility for savings to comparing different types of plans and understanding key insurance terms. By following these steps, you’ll be better equipped to make an informed decision and find a health insurance plan that provides the coverage and financial support you need.

Step 1: See if your household qualifies for savings

When comparing health insurance plans through the Marketplace, the first step is to determine if your household qualifies for savings. These savings, which can significantly lower your monthly premium, come in the form of tax credits provided by the government.

These tax credits are directly applied to your health insurance premium, reducing the amount you owe each month. It’s important to note that the savings won’t be sent to your bank account but will be automatically deducted from your premium.

Savings Qualification Criteria

All of the following must be met to qualify for savings.

Your employer’s plan is “unaffordable”. Or, you’re not offered coverage through an employer.

Most Oklahomans with employer-sponsored health coverage won’t qualify for tax credits unless the Marketplace considers their plan “unaffordable.” Here’s a guide to help you assess whether your employer’s plan meets the affordability criteria.

You don’t qualify for SoonerCare

SoonerCare is Oklahoma’s Medicaid program, offering essential health care services to low-income individuals. To check if you qualify, you can visit the MySoonerCare website.

You don’t qualify for other government programs eligibility

If you qualify for other government programs such as Medicaid, Medicare or, or TRICARE, you will not be eligible for savings.

You are within certain household income limits

In relation to the income limits for tax credit savings, if your income falls below a certain threshold, you may be eligible for SoonerCare. On the other hand, if your income exceeds these limits, you might not qualify for any savings at all.

You do not file a married filing Separate tax return

Except in specific cases involving victims of domestic abuse or spousal abandonment

There are a few more qualification questions, but this is the primary criterion.

Step 2: Compare out-of-pocket costs

Consider your family’s medical needs

While it’s impossible to anticipate every medical expense, understanding past patterns can help guide your decision. Review the type and frequency of medical treatments your family has needed in the past.

Compare benefits

The Health Insurance Marketplace will provide a link to the summary of benefits, which details the plan’s costs and coverage.

Consider a health savings account (HSA)

A Health Savings Account (HSA) is a tax-advantaged savings account available to people enrolled in a High Deductible Health Plan (HDHP) through the Health Insurance Marketplace. HSAs allow you to set aside pre-tax money to pay for qualified medical expenses, such as deductibles, copayments, and other out-of-pocket costs.

The key benefits of an HSA include:

- Tax Advantages: Contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free.

- Rollover: Unused funds roll over year to year, and the account remains yours even if you change jobs or health plans.

- Contribution Limits: For 2024, the contribution limits are $4,150 for an individual and $8,300 for a family. If you’re 55 or older, you can contribute an additional $1,000.

These plans often have lower premiums and can be a good option for healthy individuals who want to save for future medical expenses.

Lower vs higher premiums

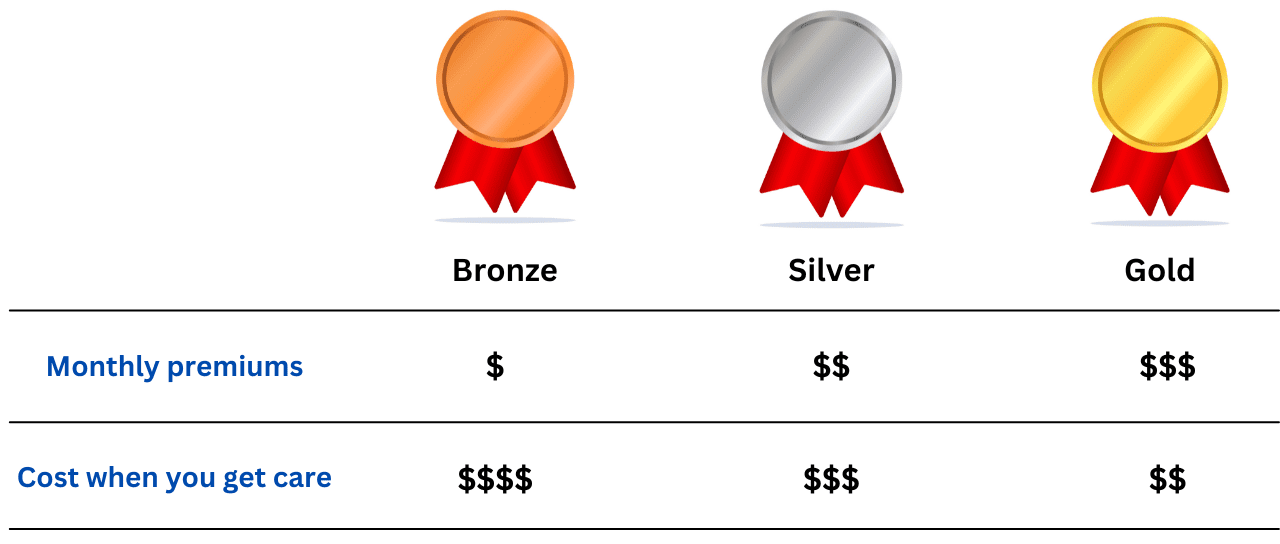

Benefits vary by metal tier:

- Bronze plans have lower monthly premiums but higher out-of-pocket costs when you need care.

- Silver plans strike a balance between premiums and out-of-pocket costs. If you qualify for a cost-sharing reduction, silver plans are especially beneficial, as they offer enhanced coverage.

- Gold plans come with higher premiums but lower out-of-pocket expenses when you access care.

Understand health insurance terms

Understanding health insurance terminology can be challenging but is crucial for making informed decisions about your coverage. Knowing the key terms can help you navigate your policy more effectively and manage your healthcare expenses. Here’s a breakdown of some essential insurance terms:

- Premium: The amount you pay for your health insurance every month, regardless of whether you use medical services or not.

- Deductible: The amount you must pay out of pocket for covered healthcare services before your insurance starts to pay. For example, if you have a $1,000 deductible, you’ll pay the first $1,000 of your medical bills yourself.

- Copay: A fixed amount you pay for a covered healthcare service, usually at the time of service. For instance, you might pay a $20 copay for a doctor’s visit.

- Coinsurance: The percentage of costs you share with your insurance company after you’ve paid your deductible. For example, if your coinsurance is 20%, you pay 20% of the cost of covered services, and your insurance pays the remaining 80%.

- Out-of-pocket maximum: The maximum amount you’ll have to pay for covered services in a calendar year. After you reach this limit, your insurance covers 100% of the costs of covered services.

- Out-of-pocket costs: The total amount you pay for healthcare services that aren’t covered by your insurance plan, including deductibles, copays, and coinsurance. This can also include costs for services that are not covered by your plan.

Each of these terms plays a significant role in determining how much you will pay for healthcare services and how your insurance coverage works. By familiarizing yourself with these definitions, you can better understand your financial responsibilities and make the most of your health insurance plan.

Step 3: Compare different types of health insurance networks

Evaluate the need for a referral system:

PPO plans

PPO plans offer flexibility by not requiring referrals from a primary care physician to see a specialist or undergo a procedure. You’re not restricted to in-network providers, though staying in-network will save you money. PPO plans might be a better choice if you live in a rural area with limited healthcare options, as they allow for more frequent out-of-network care.

HMO plans

HMO plans usually require referrals from a primary care physician to see a specialist or undergo a procedure. However, in Oklahoma, some carriers offer HMO plans that don’t require referrals. To find out if referrals are needed, check the “Summary of Benefits” for the plan you’re considering.

With HMO plans, you must stay in-network to receive coverage, except in “true emergencies”. The main advantage of HMO plans is having a primary doctor who coordinates all your care, ensuring consistency and familiarity with your medical history. Additionally, HMO plans are generally more affordable.

Find your doctors in-network

The Health Insurance Marketplace provides links to each carrier’s in-network provider search, which you should use to ensure your preferred doctors are included.

If your doctor is not in-network:

- PPO: You’ll need to pay higher out-of-network cost-sharing.

- HMO: You’ll have to switch to a new doctor.

Alternatively, you can explore other plans or networks where your current doctor is in-network.

Is a larger network important to you?

- Larger Network: Generally comes with a higher premium but provides broader access to a wide range of healthcare providers and facilities.

- Smaller Network: Typically associated with lower premiums but may limit your choice of doctors and hospitals.

- Mid-Sized Network: Offers a balanced approach, combining moderate premiums with a reasonable range of provider options.

Step 4: Compare benefits

When evaluating the plan(s) you’re considering, review the summary of benefits and focus on the specific services you anticipate using.

Here are some example questions to guide your comparison:

- Which prescriptions for my condition are covered by this plan?

- Are my medications included in the plan’s coverage?

- What maternity services are provided under this plan?

- Can I comfortably afford to pay this premium throughout the entire plan year?

Step 5: Consider adding ancillary benefits

Alongside enrolling in a marketplace plan, it’s worth considering ancillary coverage. These plans can provide financial protection in the event of an accident, hospitalization, or a diagnosis of a critical illness like cancer, a heart attack, or a stroke.

Accident Insurance – Pays a lump sum cash amount to you in the case of an accident, which can be used to pay towards your deductible and other out of pocket costs.

Hospital Insurance – Hospital insurance helps cover the costs of medical treatments and services received during hospital stays, reducing your financial burden and providing access to necessary healthcare.

Critical Illness Insurance – Critical illness insurance gives you financial support if you’re diagnosed with a serious illness like cancer, heart attack, or stroke, helping cover medical and other expenses during treatment and recovery.

Dental and Vision – Dental and vision insurance help cover the costs of routine dental care, eye exams, and related treatments.

These are separate plans that aren’t offered on the ACA Marketplace and must be purchased separately from private insurers. Get a quote for ancillary coverage.

Summary: How to Choose Marketplace Health Insurance in Oklahoma

Choosing the right health insurance plan through the Marketplace involves assessing your eligibility for savings, comparing plan benefits and network options, and understanding essential insurance terms. By considering your family’s medical needs and evaluating ancillary benefits, you can make an informed decision that balances coverage, network size, and premium costs.

Our brokers have assisted countless Oklahomans in finding the right health insurance through the Marketplace. Simply fill out this form or call us at (405) 546-2000, and let us take the stress out of your search for the right coverage.

Categories: Blog